aurora co sales tax rate 2021

Start filing your tax return now. 2020 rates included for use while preparing your income tax deduction.

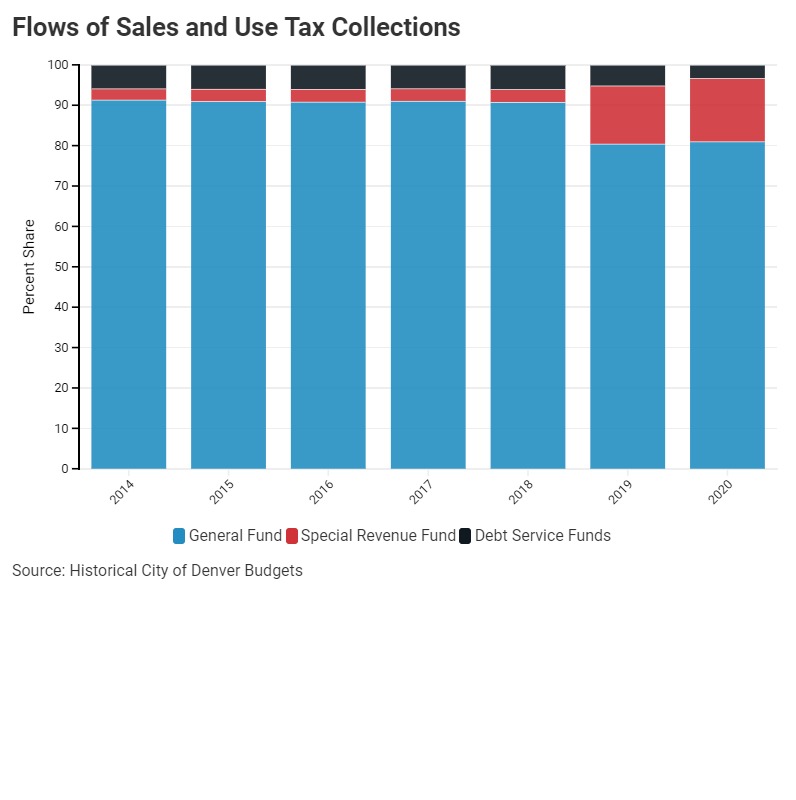

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

This clarification is effective on June 1 2021.

. Easily manage tax compliance for the most complex states product types and scenarios. Note that the State of Colorado has enacted the same clarification. Avalara provides supported pre-built integration.

Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021. The latest sales tax rates for cities in Colorado CO state. 2020 rates included for use while preparing your income tax deduction.

Easily manage tax compliance for the most complex states product types and scenarios. 2020 rates included for use while preparing your income tax deduction. Rates include state county and city taxes.

Aurora MO Sales Tax. This rate includes any state county city and local sales taxes. Effective July 1 2022.

0375 lower than the maximum sales tax in MO. Updated 12021 Effective July 1 2006 the. Aurora MN Sales Tax Rate.

This rate includes any state county city and local sales taxes. Aurora SD Sales Tax Rate. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. Aurora-RTD 290 100 010 025 375. The December 2020 total local sales tax rate was also 8000.

An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80011 80012 80014 and 80019. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. Method to calculate Aurora sales tax in 2021.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The minimum combined 2022 sales tax rate for Aurora Colorado is 8. The current total local sales tax rate in Aurora CO is 8000.

MO Rates Calculator Table. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. TAX DAY NOW MAY 17th - There are -476 days left until taxes are due. Aurora OR Sales Tax Rate.

Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Try our FREE income tax calculator Tax.

What is the sales tax rate in Aurora Colorado. Aurora collects a 56. 2020 rates included for use while preparing your income tax deduction.

The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

This is the total of state county and city sales tax rates. Aurora co sales tax rate 2021 aurora co sales tax rate 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Retailers are required to collect the Aurora sales tax rate of 375 on. This rate includes any state county city and local sales taxes. Groceries are exempt from the Aurora and Colorado state sales taxes.

March 20 2021 March 20 2021 By world of. There are approximately 213758 people living.

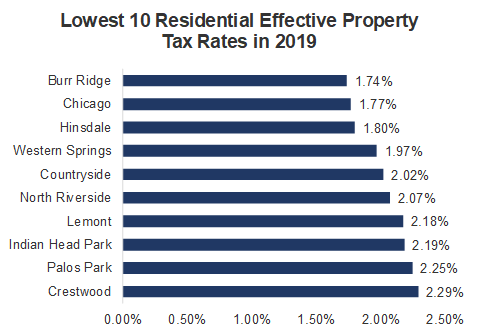

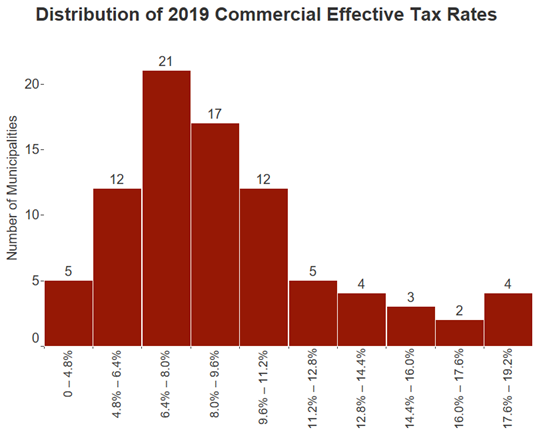

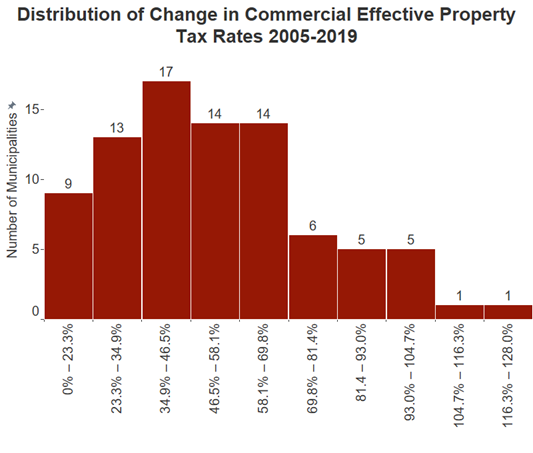

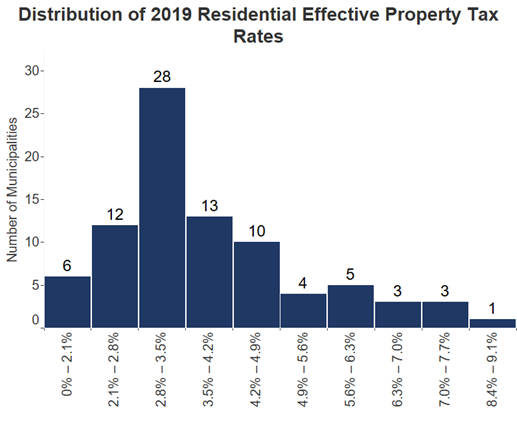

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Aurora Kane County Illinois Sales Tax Rate

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

Kansas Sales Tax Rates By City County 2022

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation